Features

SoftCore's Advanced Features

Being a “browser-based multi-device software”, SoftCore can operate on computers, laptops, tablets as well as mobiles. This will bring a paradigm shift in credit society operations. Due to tablet banking last mile serviceability through agents, shopkeepers and CSP will now be possible. SoftCore has advanced cloud deployment. Now all the benefits of cloud technology that were only accessible to large financial institutes till now, shall be available to credit societies as well.

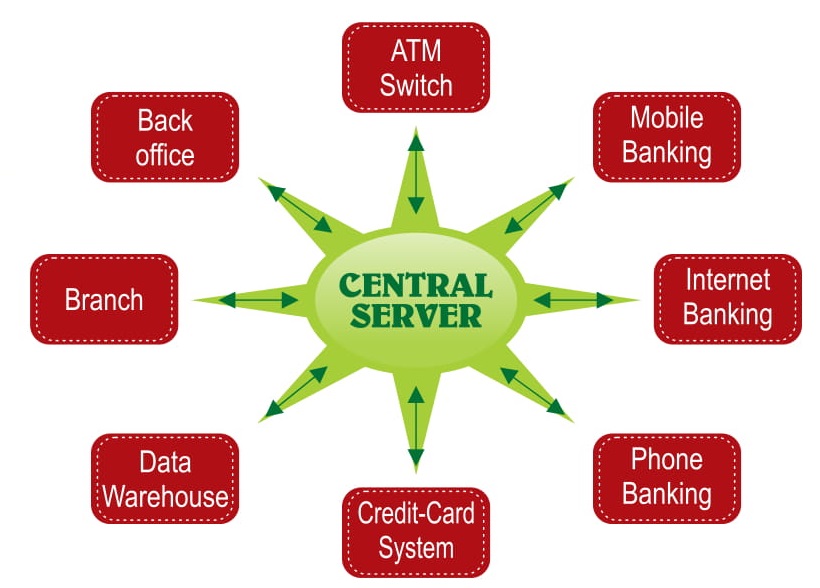

Delivery Channel Support

-

ATM/ PointofSale

-

Internet Banking

-

Phone Banking

-

SMS Banking

-

Mobile Banking

-

Kiosk Banking (Touch Screen)

Special Features

-

Comparative analytical reports - branch, location wise

-

All Branches daily summary

-

Ratio Analysis

-

Audit Grade Reports

-

Specialised additional modules for Employees CCS

-

Interbranch transactions support for any branch banking

-

TDS Management Module

-

GST ready

-

Pigmy Machine Interface

-

Membership application processing - new, closure, transfer

Unmatched Technology

Browser based with responsive user interface for Multi-device support - Works on computer, laptop, tablet and mobile

Works on any operating system - Windows, Linux, Mac OS, etc.

Cloud based deployment

Dedicated software based firewall

Application level proprietary Disaster Recovery (DR) system

Available on Software as a Service Model (SaaS)

No additional software required at branches

Deployment in Tier IV certified data center

Multilingual Interface

Key reports in 2 languages (Bilingual reports)

Management system and Customized reports availability

Biometric Integration

Third Party API Interface (Sponsor banks, CRM, SMS, SIMFI etc.)

Push and Pull SMS (Missed call, 2 way SMS)

Innovative and Futuristic

Missed call based new customer registration / balance enquiry

QR code based smart cards

Mobile app based POS for merchants

Credit Card Scheme for members

Micro ATM - Cash@POS

IMPS and NEFT directly from customer mobile banking app

Open loop and Close loop Mobile POS system

AEPS : Aadhar Enabled Payment System

Pigmy collection with new features

Online Pigmy Collection

Offline synchronisation

Direct debit to agent account

Utility bill payments, DTH, mobile recharge

Safe and Secure

-

Extensive user access control rights like other branch report view, field based rights, etc;

2 factor user authentication at login (2FA)

OTP / Biometric facility

SSL Link Level Security

Encryption of important data

Dedicated Firewall

Audit Trail Reports

Edited / Deleted transaction log reports

Report generation log

Customer's Mobile number verification on registration using OTP

User IP and MAC tracking

For highest security various user rights such as report view rights, transaction rights, fieldwise rights etc.

Single user single login

Various backend process report like posting, SI execution, SMS etc. on a single log report

User locking in case of multiple failures in login attempt

User session expires after set period of inactivity

Exception Reports like dormant accounts, accounts with negative balances, Clients with incomplete KYC, user sessions after working hours, etc.

Client wise per day cash transaction limit

User-wise transaction limit

HO level passing of high value transactions

Highly Productive

User friendly, easy to use

Enter key based operations and shortcut keys

Menu driven - Consistent user interface

Enquiry - details of a client and its accounts on single click

Reports exports to PDF, Excel and other formats

Docket - Automated reports generation email facility

Daily recovery, overdue of all branches and Consolidated MIS reports

Automated day end

Automated reminder SMS to customers

Automated Directors MIS SMS

Multiple slab FD a/c renewal on single click

Bulk transactions - Centralised on single click for all branches

Automated Standing Instruction (SI)

Auto bank reconciliation based on Excel import

Auto bank transfers using Host to Host connectivity

Pigmy collection imports from pigmy machines and mobile apps with transaction posting

Automated demand (requisition) generation for employees ccs

Bulk FD / Day book printing

Multi GL passbook printing

Bulk Dividend Warrant with address printing

Bulk Postal Address printing for Annual reports